24+ transfer taxes mortgage

Web No transfer taxes are not tax deductible since they are a charge to legally transfer a real estate title. These are often felt to be one of the more complicated taxes because the rate does not only differ by state but also between.

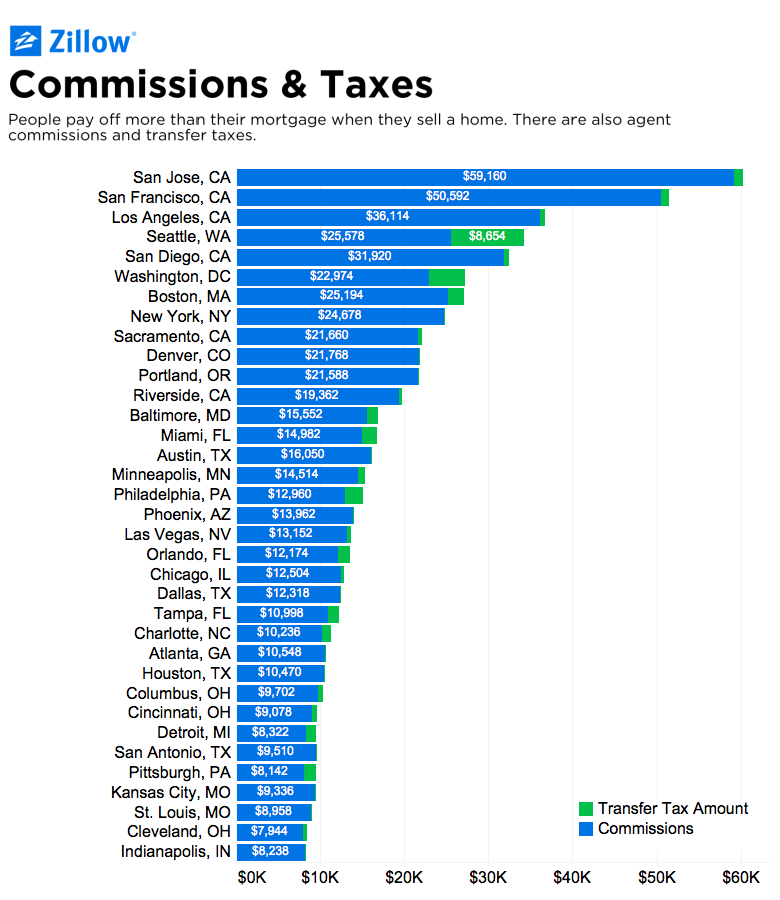

Transfer Taxes A Rude Surprise For Some Home Sellers Zillow Research

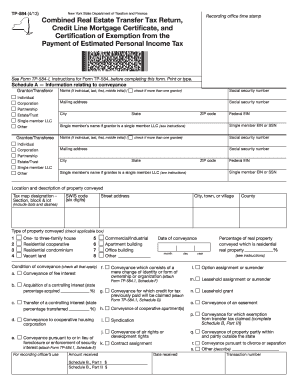

Web You must pay the Real Property Transfer Tax RPTT on sales grants assignments transfers or surrenders of real property in New York City.

. Answer Simple Questions About Your Life And We Do The Rest. Some states charge a flat tax while others charge a percentage based on the sales price. The amount youll pay in real estate transfer taxes will depend on where you live.

Ad Compare Your Best Mortgage Loans View Rates. Ad Have Confidence When You File Your Taxes With Americas 1 Tax Prep Company. A transfer tax is a type of tax thats assessed when money or property transfers between two parties in certain situations.

Web Deed transfer tax rates vary by state. In parts of Pennsylvania it can. Web The District of Columbia imposes a deed transfer tax of 11 on residential property worth less than 400000 and 145 on property worth more than 400000.

You must also pay RPTT for. Web You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined. Web How much are real estate transfer taxes.

CITE Pursuant to 19 RCNYSection 23-03 d 3 formally Article 24 c of the Real Property Transfer Tax regulations a transfer of real property from one. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes. Get the Right Housing Loan for Your Needs.

The transfer tax is ad valorum Latin for to the value and comprises a percentage of the deeds total worth. Web Property Transfer Tax. Web Additional Transfer Taxes in New York This means that if you purchase a 4 million home in New York City with a 3 million mortgage your transfer taxes would be.

Like many things there is one exception to this rule. Web The exact amount of real estate transfer taxes varies by where you live. Depending on where you live you may have.

Web refinance transfer taxes florida mortgage refinance cost florida transfer taxes mortgage florida mortgage refinance tax florida state mortgage tax refinance mortgage transfer. Web How a Transfer Tax Works. Web A transfer tax is a real estate tax usually paid at closing to facilitate the transfer of the property deed from the seller to the buyer.

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns. Compare Offers Side by Side with LendingTree.

Real Estate Transfer Tax Hidden Additional Cost Explained Real Estates

Real Estate Transfer Tax What Are They Where Does The Money Go

Gold Price Usd Definition Financial Dictionary Fxmag Com

Trading De Credito Bonds Exercicio Previo Pdf Pdf Standard Poor S Earnings Before Interest

Dheeraj On Twitter Transfer Tax Definition Examples Calculate Transfer Tax Https T Co Omxifjid5m Transfertax Https T Co Kd9ujug2qn Twitter

Real Estate Transfer Taxes Deeds Com

Fillable Online Realpropertyabstract Printable Combined Real Estate Transfer Tax Return Tp584 Form Realpropertyabstract Fax Email Print Pdffiller

Real Estate Transfer Tax Hidden Additional Cost Explained Real Estates

Smithsfalls110217 By Metroland East Smiths Falls Record News Issuu

Document

All Taxes You Have To Pay When Buying A House Transfer Tax Mortgage Tax Co Real Estates

24 Sample Sale And Purchase Agreement In Pdf Ms Word

Currency Partners Import Export Experts

What Are Real Estate Transfer Taxes Bankrate

Betterment Resources Original Content By Financial Experts App

Does Your State Have An Estate Income Tax Or Transfer Tax Cjm Wealth Advisers

Mortgage Broker Randwick Coogee Maroubra Kensington Mortgage Choice