30+ deduct home mortgage interest

Jinesh bought his five-bedroom detached property in Watford in 2012 for 440000. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

How To Maximize Your Mortgage Interest Deduction Forbes Advisor

A basis point is equivalent to 001.

. Publication 936 explains the general rules for. Web Most homeowners can deduct all of their mortgage interest. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. Web For 2021 tax returns the government has raised the standard deduction to. 13 1987 your mortgage interest is fully tax deductible without limits.

Married filing jointly or qualifying widow. A month ago the average rate on a 30-year fixed refinance. Web So lets say that you paid 10000 in mortgage interest.

And lets say you also paid 2000 in mortgage insurance premiums. Ad This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes. 1 2018 you can deduct any mortgage interest you pay on your first 750000 in mortgage debt 375000 for.

Web If you took out your mortgage on or before Oct. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Also if your mortgage balance is.

Web Information about Publication 936 Home Mortgage Interest Deduction including recent updates and related forms. Web A home mortgage interest deduction is a tax deduction that helps homeowners reduce their federal tax returns by claiming interest paid on home. Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness.

See what makes us different. Web 2 days agoThe average 30-year fixed mortgage interest rate is 708 which is an increase of 7 basis points from one week ago. Compare offers from our partners side by side and find the perfect lender for you.

But for loans taken out from. We dont make judgments or prescribe specific policies. So your total deductible mortgage interest is.

Web Deducting points means you can deduct 130th of the points each year if its a 30-year mortgagethats 33 a year for each 1000 of points you paid. Single or married filing separately 12550. Ad Lock In Lower Monthly Payments When You Refinance Your Home Mortgage.

Web Up to 96 cash back You can fully deduct home mortgage interest you pay on acquisition debt if the debt isnt more than these at any time in the year. However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness. Web If youve closed on a mortgage on or after Jan.

Web 1 day agoThe current average interest rate on a 30-year fixed-rate jumbo mortgage is 728 014 up from last week. Web The average 30-year fixed-refinance rate is 712 percent down 2 basis points compared with a week ago. In the year you.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Homeowners who bought houses before December 16. Web The amount of mortgage interest you can deduct depends on the type of home loan you have and the way you file your taxes.

If you are single or married and. 750000 if the loan was finalized. Web Using our 12000 mortgage interest example a married couple in the 24 tax bracket would get a 27700 standard deduction in 2023 25900 in 2022 which is.

Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on. Web 1 day ago30-year fixed-rate mortgages. For a 30-year fixed-rate mortgage the average rate youll pay is 711 which is an increase of 8 basis points from one week ago.

Web Jinesh Vohra 38 managed to pay off his mortgage in four years after saving hard. In the past you could deduct the interest from up to 1 million in mortgage debt or 500000 if you filed singly. Web Mortgage interest.

The 30-year jumbo mortgage rate had a 52-week low. The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns.

The Home Mortgage Interest Deduction Lendingtree

Rgv New Homes Guide Issue 30 Vol 4 November December 2022 January 2023 By New Homes South Texas Issuu

Use These Charts To Quickly See How Much The Higher Mortgage Rates Will Cost You

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

Should You Lock Your Mortgage Rate Today Forbes Advisor

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Calculating The Home Mortgage Interest Deduction Hmid

Home Mortgage Interest Deduction The Primary Residence Election

Mortgage Interest Rate Deduction Definition How It Works Nerdwallet

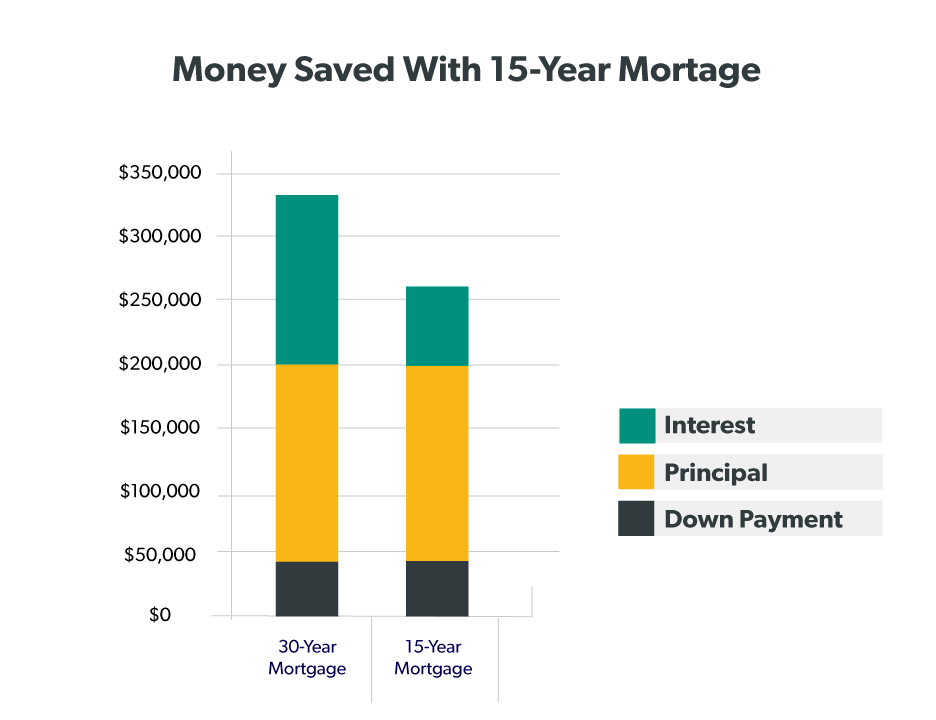

15 Vs 30 Year Mortgage Which Is The Best Choice White Coat Investor

What Is A 30 Year Fixed Rate Mortgage Ramsey

Some Mathematics Of Investing In Rental Property Floyd Comap

Drop In 10 Year Treasury Yield Mortgage Rates Is Just Another Bear Market Rally Longer Uptrend In Yields Is Intact With Higher Highs And Higher Lows Wolf Street

6 Tax Deductions For Small Businesses Gocardless

30 Year Fixed Rate Mortgage Interest Rate Download Scientific Diagram

Mortgage Interest Deduction Bankrate

S 1